Etymology of 'Ameron'

Ameron is a fee-for-time cryptocurrency managed by artificial intelligence (AI) for centrality. Ameron is pegged to time on robotic labor for intrinsic value. The main functioning lies with GPT for Robotics. Ameron is a compound word of 'America' and 'On' in English. It means 'Asian-American currency' in Chinese, Korean, Japanese, and Vietnamese. Ameron is meant to be a global reserve currency.

亞美元

"Ya-mei-yuan"

Chinese

아미원

"Ah-mi-won"

Korean

アメ元

"Ame-moto"

Japanese

Á Mỹ Nguyên

"Á Mỹ Nguyên"

Vietnamese

Vision

Modern global society is entrenched in a zero-sum Nash equilibrium that trends toward the end of growth. Ironically, the only thing that saves us from such an outcome is its unsustainability. The predicted outcome is class warfare and failed states. The redistribution tax solution is unrealistic, as most globalized democracies have become plutonomies.

The Solution: Use Pareto distribution against itself, without direct taxation on the wealthy, that can enable lower-class entrepreneurial credit creation, risk management for investors, universal basic income (UBI) for the poor, and manumitting buyouts of slaves. For this to occur, control of capital — land, labor, and energy — must be transferred to a central bank led by artificial intelligence, working with self-replicating robots.

'Smart' Cryptocurrency

The United States Dollar's status as the global reserve fiat currency has led to massive balance of payment and trade deficits that fueled public and private debt while destroying family farmers, blue-collar manufacturing workers, the middle class, and the working poor.

Last year alone, a hyper-Keynesian ~300% expansion in the M1 money supply in COVID-19 stimulus threatened the global financial system. It has created unprecedented bubbles in equity markets, cryptocurrency, and real estate. The world requires a new global reserve currency independent of any nation-state, lest that country bears the same reserve currency curse.

Ameron Blockchain

Every existing cryptocurrency may be considered a 'dumb' coin, and Ameron would be the first AI-regulated 'smart' coin. Cryptocurrency crashes in recent years exposed the weakness of extant blockchains in their ability to process large-scale transactions and abnormally high trading volume. The Hyperledger Fabric or comparable environment would avoid such transaction bottlenecks.

Every Ameron would be accounted for on the central ledger; its integrity and tax compliance would be guaranteed by the Hedera Hashgraph consensus mechanism or an equivalent.

Transaction Speed

On par with VisaNet's 65,000 transactions per second processing capacity.

Transparency

No transaction will be anonymous to prevent risky exposure of small-time investors to market manipulation.

Ameron would seek to remove the volatility by removing the reliance on market sentiment and speculation rather than seek to compete directly with Bitcoin. Trade settlement will be done in real-time through the blockchain.

The Ameron Central Bank's Settlement Network

The Ameron blockchain will be centrally managed by a Central Bank, led by artificial intelligence. Intraday liquidity for large-scale B2B flows represents a challenge for the Ameron Central Bank. The recent 2021 cryptocurrency crash exposed the weakness of existing blockchains in handling large volumes.

It is unclear to the public whether this was caused by an issue in the Fedwire network or a systemic flaw in the shadow banking system, i.e., the interbank market or money market funds. A possible explanation is offered by Biliana Alexandrova-Kabadjova, an economist at the Bank of Mexico, who has implied that Real-Time Gross Settlement (RTGS) networks (like Fedwire) require more liquidity than Deferred Net Settlement (DNS) networks (like Payments Canada).

The Ameron Central Bank will be designed to handle large volumes — 24/7, 7 days/week, and 365 days/year — to provide even the largest banks and institutions with the requested liquidity at par value.

Ameron's Technical Specifications

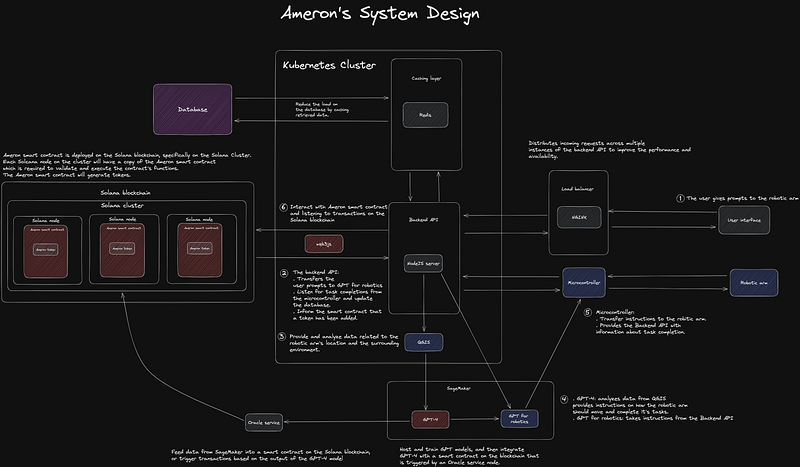

Ameron's System Design Architecture

Solana Blockchain Cluster

Host and run the Ameron smart contract. Each Solana node in the cluster will maintain a copy of the Ameron smart contract. The smart contract is responsible for generating tokens and validating as well as executing contract functions.

Kubernetes Cluster

Scale the backend API and manage workloads. The backend would be on a NodeJS server that translates user prompts into actions for the robotic arm. It fetches controller scripts from the database and updates the database with token information when a new token is issued. The caching layer would utilize Redis to reduce load on the database.

Oracle Service

Provide and analyze data related to the robotic arm's location and surrounding environment. Feeds data from Amazon SageMaker into a smart contract on the Solana blockchain. The output of the GPT-4 model is then used to trigger transactions on the blockchain.

GPT-4 Integration

Host and train GPT models, and then integrate GPT-4 with a smart contract on the blockchain. GPT-4 for robotics analyzes data from sensors, and based on that, it should move and complete its tasks. Instructions are taken from the Backend API and executed accordingly.

The Ameron Central Bank's Monetary Policy

The central banks of most major economies have bought into former Bank of Japan economist Richard Werner's monetary theory of quantitative easing. While effective in quashing market crises, quantitative easing's over-use in promoting growth and capital creation during times of agnostic investors' confidence leads to diminishing returns on investment, increased risk, and increased entropy.

Further, monetary policy based on orthodox economics has failed to conform to the laws of thermodynamics. Ameron's central bank will utilize the heterodoxic biophysical, or thermo-economic, school of economic thought.

Key Economic Equations

- • Conditional Expectation of Exponentially Transformed Random Variables

- • Shannon Entropy (H) - Single market's state

- • Shannon Entropy (H) - Combined uncertainty of two markets

- • Conditional Entropy - Uncertainty of a market state considering its own history

- • Mutual Information (I)

- • Intermarket Transfer Entropy (T)

- • Quantitative Easing (QE)